by Rickard Linder

WUCHANG: Fallen Feathers – China’s next $100M+ breakout title?

Launching July 24, 2025 on Steam, Epic, PS5, Xbox Series X|S & Game Pass day one

Narrative moves markets, and in China, everyone is still talking about Black Myth: Wukong. For years, gacha- and IAP-monetized mobile and online games dominated China’s gaming market. However, single-player, narrative-driven experiences on PC and console are becoming more popular in China – especially if they tell stories that resonate in the Chinese market.

With Black Myth, Game Science proved that Chinese devs can now deliver polished, high-quality titles that compete on the global stage. When the world’s largest gaming audience shifts, the industry takes notice.

It’s the perfect moment for WUCHANG: Fallen Feathers to take the spotlight. Let’s dive in.

Developed by Lenzee and published by Digital Bros, WUCHANG: Fallen Feathers takes place in the late Ming Dynasty. The land of Shu is torn apart by brutal conflict, and a strange illness, that turns people into terrifying creatures.

Roughly 60% of WUCHANG’s wishlisters have also played Black Myth: Wukong. Alinea estimates that Black Myth has sold over 15 million copies on Steam, 6 million on PlayStation and 4 million on other platforms (primarily WeGame).

The majority of Black Myth’s players are based in China. Engagement is staggering for a single-player game. Around 40% of Black Myth players on PlayStation and Steam players have logged 50+ hours of gameplay. This is an exceptional feat for a single-player game, especially one whose main story takes 15-20 hours to finish. Players clearly loved exploring Black Myth’s world.

With $1B+ in gross revenue on a $42M dev budget, Black Myth ranks among the fastest-selling, most profitable games of all time – and via a new IP to boot. Somewhere, a banker probably choked on their latte.

Want more insights like this delivered straight into your inbox? Subscribe to the Alinea Insight newsletter.

WUCHANG: Fallen Feathers is targeting a similar audience, hoping for a similar result. Gamers are hungry for the next myth-rich, cinematic, single-player adventure. The souls-like faithful. The dark fantasy diehards.

While the jury is still out, WUCHANG looks poised for success. Alinea’s pre-release Steam affinity data confirms this, also revealing that WUCHANG attracts fans of culturally inspired RPGs rooted in Japanese traditions.

Social chatter paints a similar picture, with these games mentioned as key reference points.

This audience is both LARGE and highly ENGAGED.

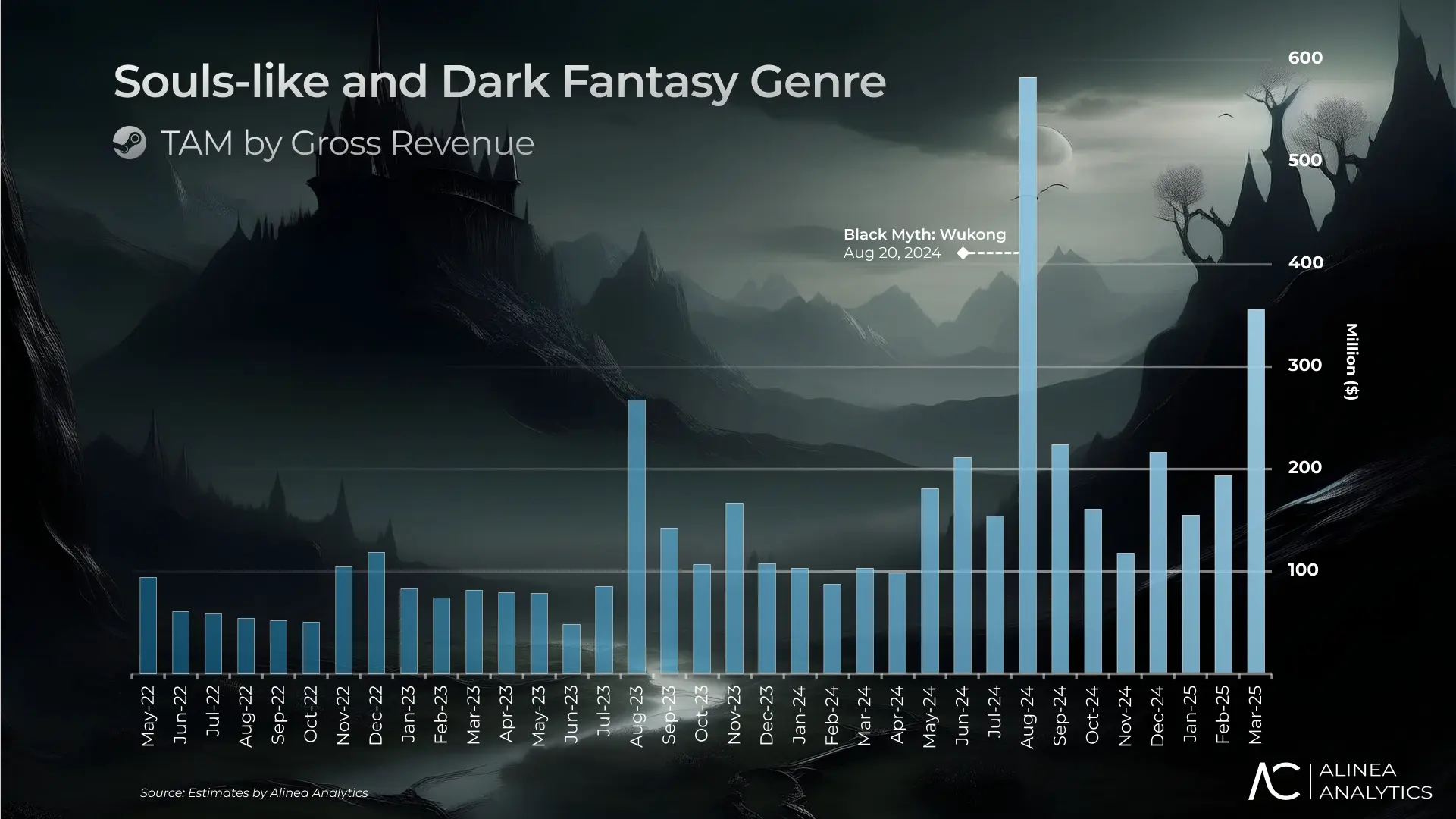

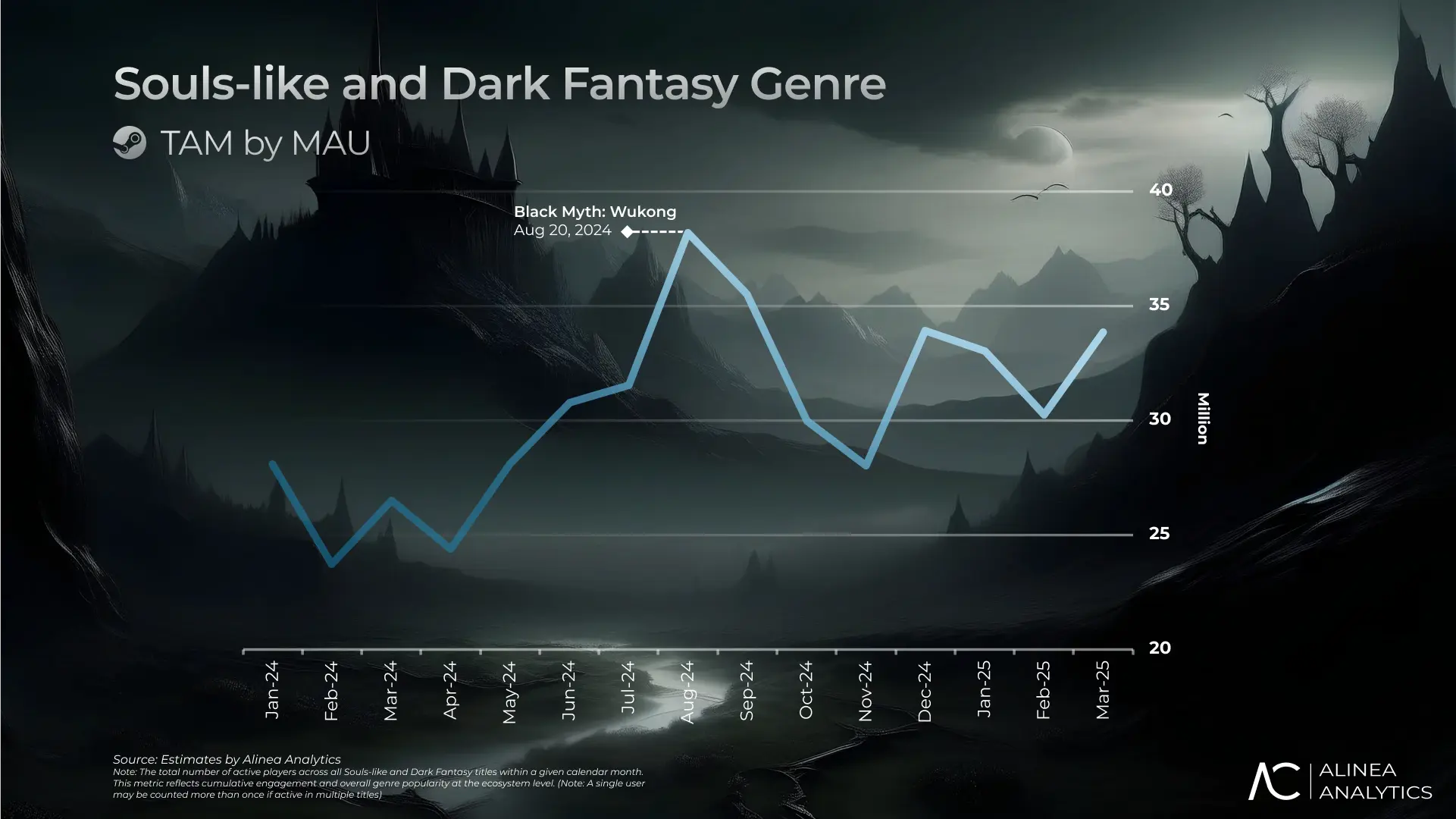

The total addressable market (TAM) for the souls-like genre and dark fantasy theme has seen significant commercial growth over the past three years (even beyond Black Myth: Wukong).

What was once a ~$50M/month segment has more than doubled, now consistently generating over $100M per month and trending toward a new baseline of $150–200M. Elden Ring truly opened the floodgates, and gamers are eating the genre up.

The genre boasts 30M+ cumulative monthly active players (MAU), reflecting a HUGE and highly ENGAGED player base – one WUCHANG is well-positioned to reach. Its genre fit and early momentum make it a strong candidate to activate Steam’s discoverability systems, including the Discovery Queue, for fans of souls-like dark fantasy games.

TAM HIGHLIGHTS:

Using the Alinea platform (reach out here for a trial!), we filtered the souls-like dark fantasy genre to only include titles with a single-player mode (yes, that excludes games like Warhammer 40,000: Darktide). We found that:

- 30 Steam titles in this group have each grossed over $10M in lifetime revenue over the past three years.

- Of these, 27 were premium titles, two were F2P, and one was a paid DLC.

- Notably, 19 reached this milestone within their first month of release.

Can WUCHANG be the next souls-like hit on Steam?

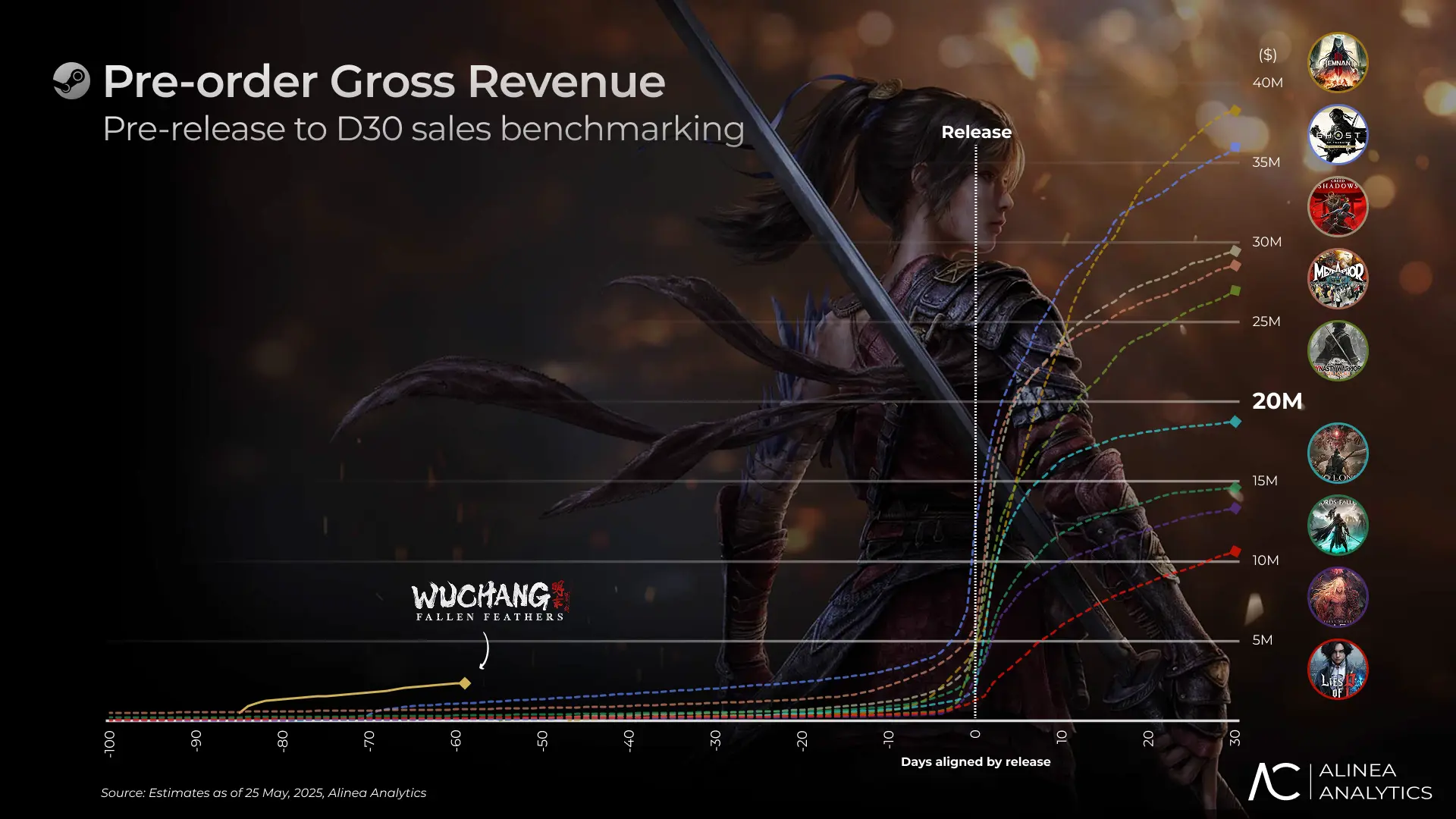

Let’s take a closer aggregated look at genre titles that have each surpassed $10M in gross revenue on Steam, excluding DLCs and F2P games for a more relevant comparison to WUCHANG.

-

Median Pre-orders: $3.4M.

WUCHANG is currently at $2M+, with two months to go. -

Median Followers at launch: 53K.

WUCHANG stands at 123K. -

Median Wishlist rank at launch: #19.

WUCHANG is currently at #49. -

Median Price Point: $49.99.

WUCHANG also launches at $49.99.

- China: WUCHANG at 40% off $ price vs. e.g., Black Myth at 45% off.

- Most titles offer Deluxe Editions ~$10 higher, aligning with WUCHANG’s $10 upgrade -

Game Engine: 9 Unreal Engine, 6 Unity and 13 proprietary/other.

WUCHANG runs on Unreal Engine 5. -

Median OpenCritic Score: 83

WUCHANG’s review embargo will lift closer to its July launch. -

Median User Score: 87%, based on 2.4M+ reviews.

For WUCHANG, Wo Long: Fallen Dynasty, which holds the lowest user score at 49%, is the second most common source of wishlisters. This makes it a critical reference point for understanding and addressing shared audience expectations.

Let’s dive into the forecasting.

Below is a two-tiered benchmark group, which we selected carefully from WUCHANG’s affinity data.

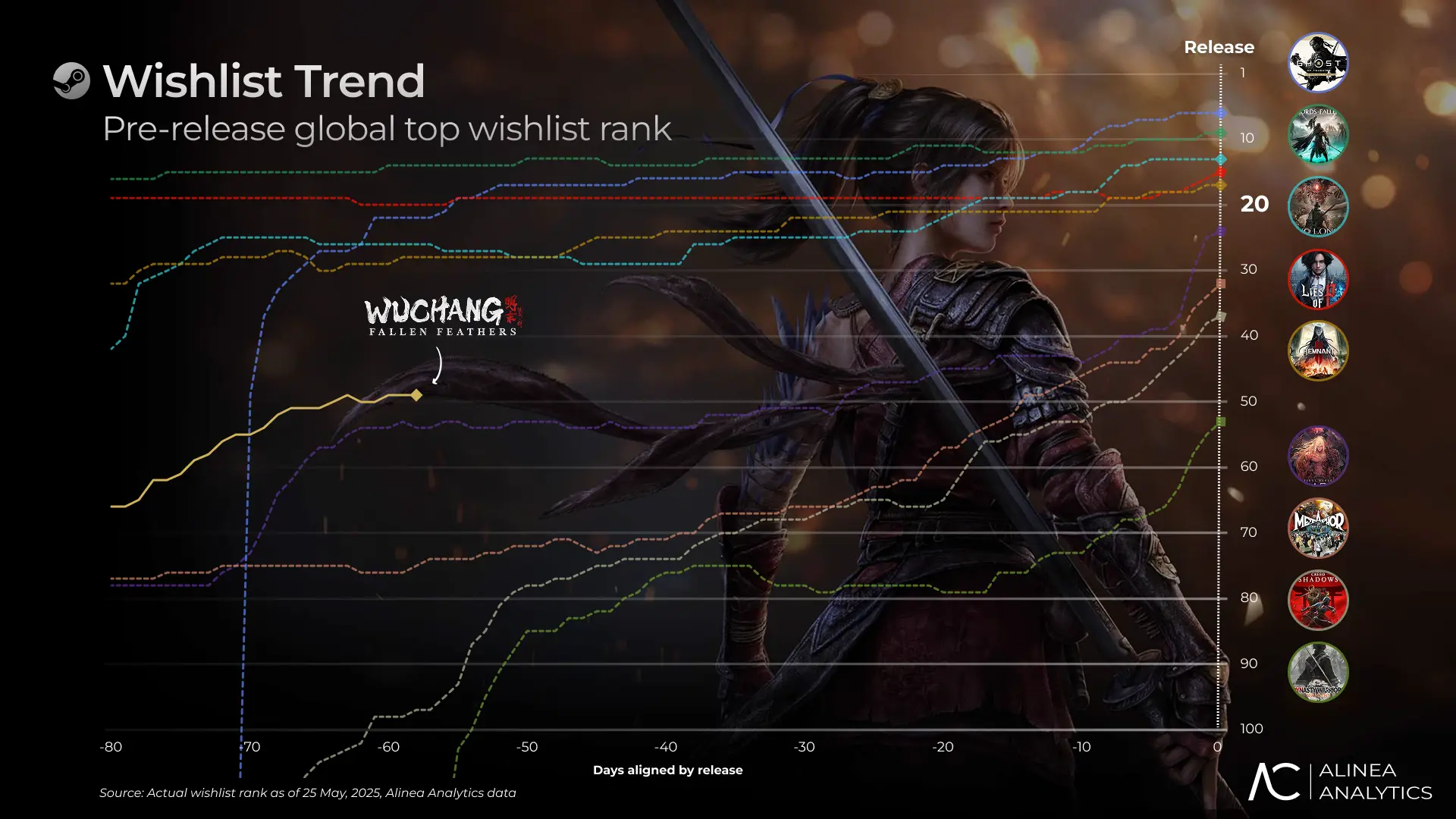

WUCHANG is currently trending well ahead of peer benchmarks that reached $30M+ in first-month Steam sales. However, as the turquoise line representing Wo Long: Fallen Dynasty (user score of 49%) illustrates, early interest only sets the stage. Ultimately, week 1 performance and user reception decide how high the game will climb.

Luckily, the Alinea platform features user reception and week 1 performance for revenues and engagement. See for yourself.

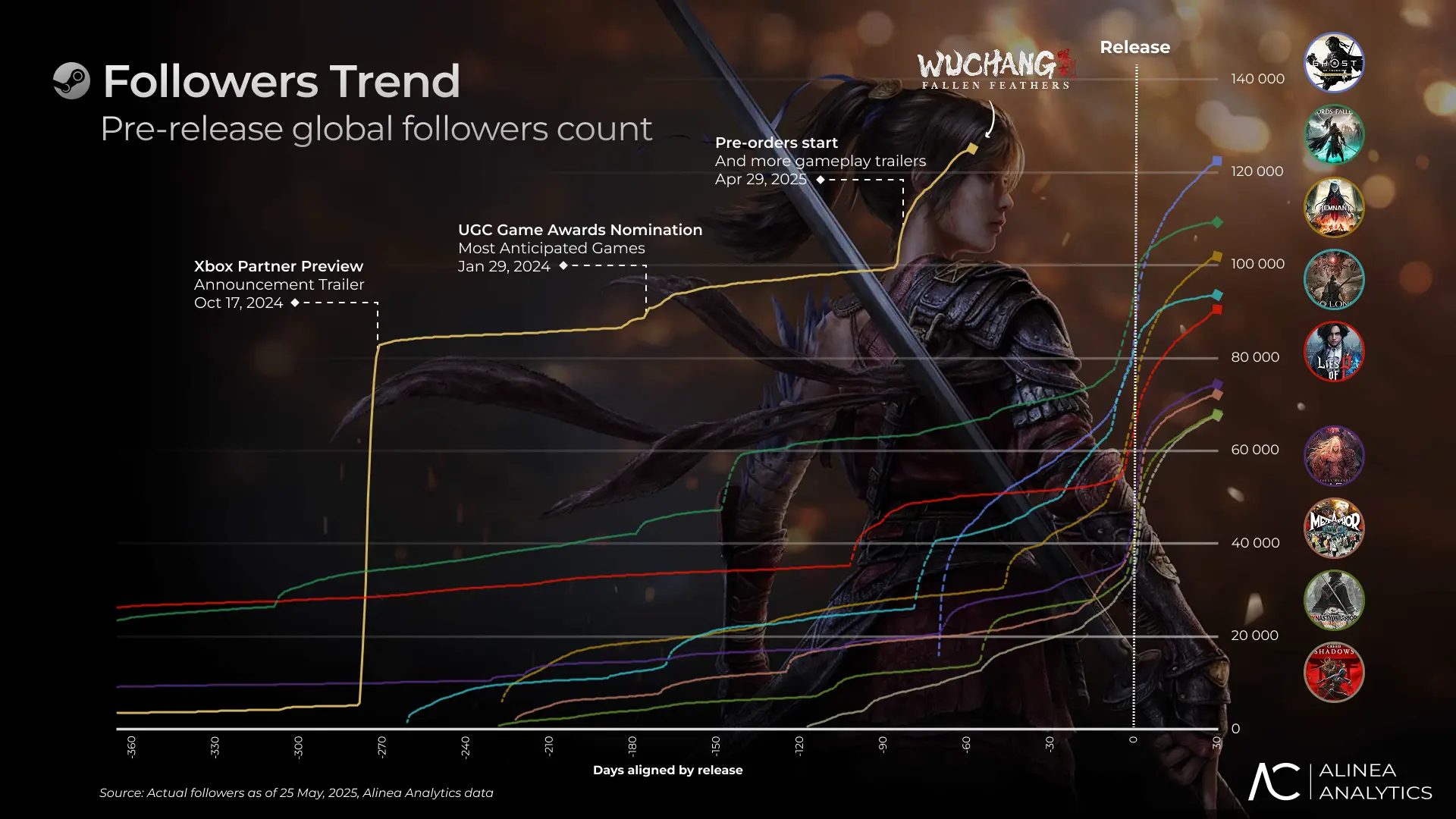

Beyond pre-orders, which offer perks like cosmetics, a skill upgrade and a weapon, the social buzz around WUCHANG is equally impressive.

An Xbox partnership heavily contributed to WUCHANG’s initial marketing. Xbox missed out on Black Myth, and it does not want to make that same mistake twice.

Following the Xbox Partner Preview in October 2024, WUCHANG quickly went viral in China. The trailer racked up over 7 million views on Bilibili within days and has since amassed over 17,000 comments and 385,000 likes. And this wasn’t just surface-level hype; it drove real engagement, contributing to 80,000+ Steam followers at the time.

After a brief plateau following the Partner Preview event, momentum surged again, with more than 40,000 new followers gained, growth that outpaces most titles on its own. WUCHANG now ranks as the 16th most-followed upcoming Steam game and #3 among those with a confirmed release date, boasting over 120,000 followers.

This volume of followers – made up of fans eager for community news – far exceeds benchmark titles. Again, this all bodes well for WUCHANG’s success.

With two months remaining, WUCHANG is on track to hit 200,000 launch followers. Just 10 titles across all games have ever reached 200K+ followers at launch.

However, all but two of these titles also held the #1 spot on the upcoming wishlist chart. Currently, WUCHANG sits at #49 on the wishlist chart, which, given its large follower base, is a larger divergence than usual. This is a cultural difference spanning from the game’s China-heavy fanbase.

In China, follower count and engagement on local platforms are often more telling. This might suggest that its audience is more focused on following news and updates than simply waiting for launch or discount notifications.

Still, #49 for wishlists is nothing to sneer at, and WUCHANG is still expected to break into the top 20 by launch. Over the past three years, only three full games have grossed less than $10M lifetime from that position.

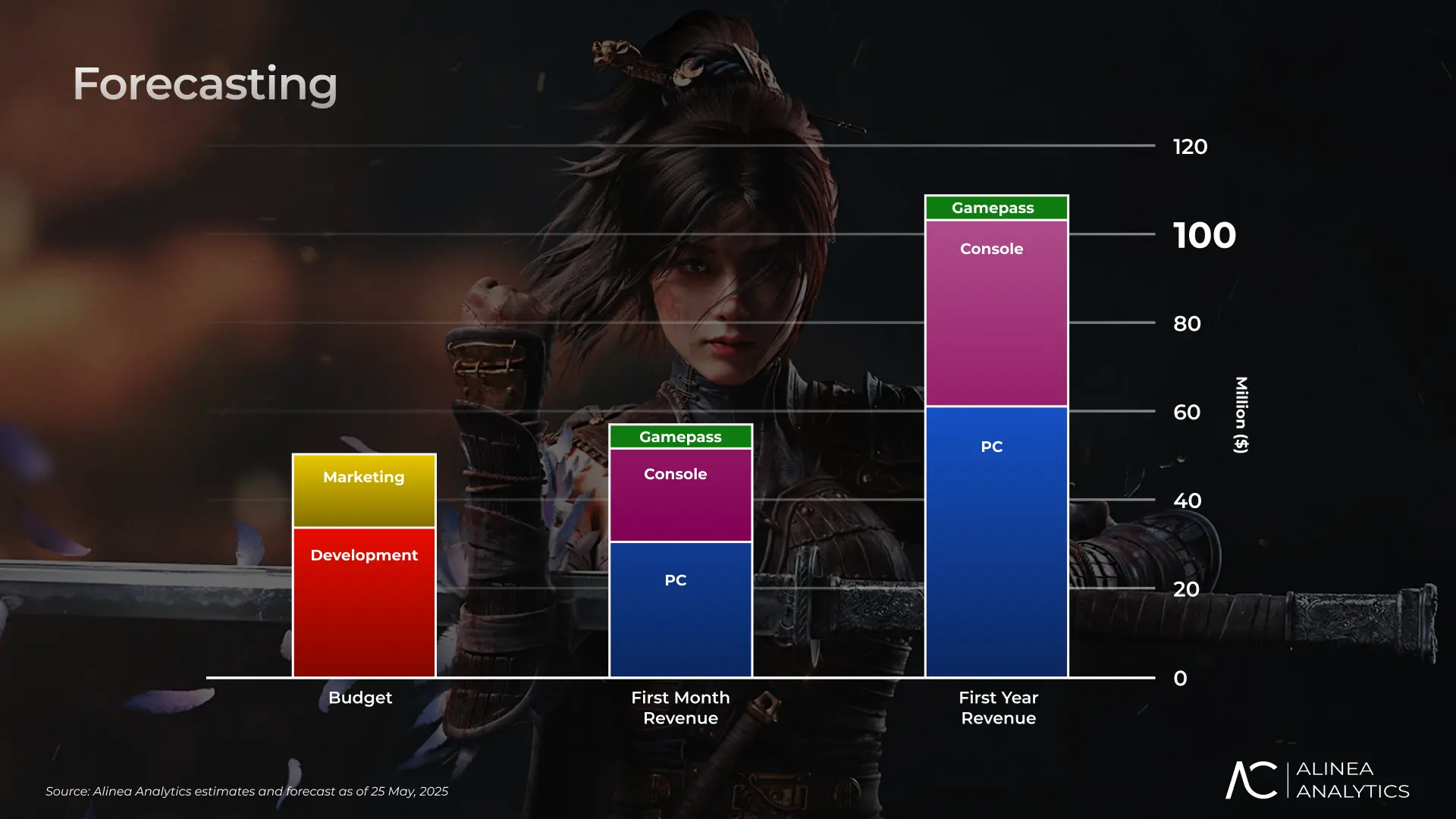

To estimate if WUCHANG could become a $100M+ title, here’s a back-of-the-envelope calculation based on benchmarks:

PC

Based on current Steam pre-launch metrics, WUCHANG is tracking in the top tier of comparable titles. A realistic, even conservative, target would be $30M+ in first-month gross revenue, placing it among the top 3 benchmark titles in this cohort.

For context, $30M would place the title among the top 40 best-selling premium games on Steam in the last three years. But again, conversion depends on launch performance, user reception and media takeover.

A $30M first month implies over 800,000 copies sold, assuming a 50/50 split between China ($30 avg.) and Rest of World ($40 avg.), with 80% Standard and 20% Deluxe editions.

Applying a somewhat front-loaded 50% first-month-to-first-year multiplier, WUCHANG would be on track for $60M in Steam revenue over its first year. However, if conversion rates hold and momentum sustains, $100M+ is achievable on Steam alone.

On the Epic Games Store, global pre-orders peaked at #7 among paid titles. Let’s add an estimated 20K units in the first month, or $700k+ in additional revenue.

Unfortunately, the title doesn’t seem to appear on WeGame, a platform where Black Myth likely sold millions of copies. That said, Tencent owns WeGame and holds a minority stake in Game Science (Black Myth’s developer), somewhat explaining this.

Console

But PC is just the beginning, as the souls-like genre thrives on PlayStation, especially in the US and Asia. PlayStation is also growing as a brand in China.

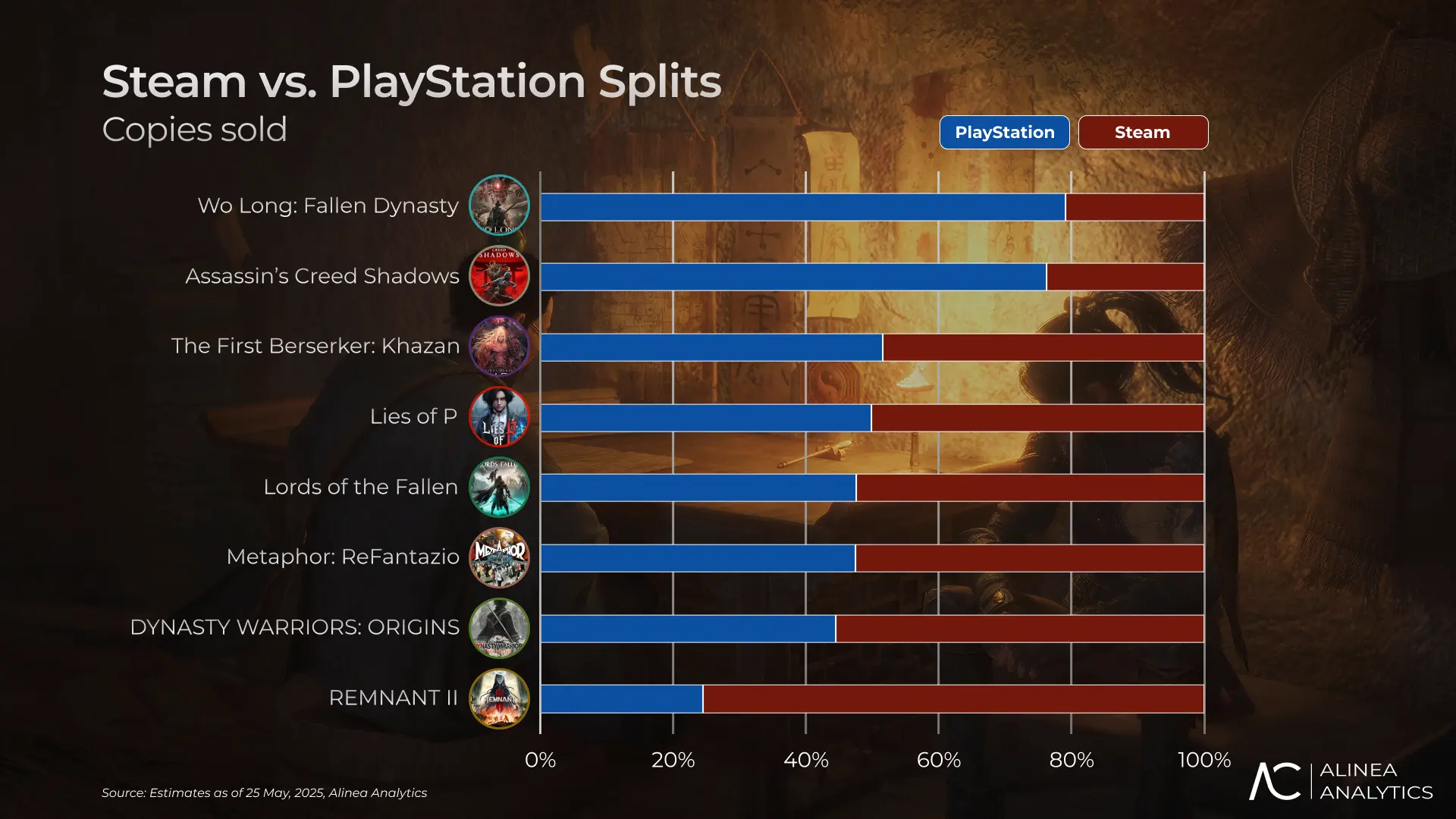

Below is a comparison of Steam vs. PlayStation for key benchmark titles. Excluding Ghost of Tsushima, a Sony exclusive that sold over 15 million copies on PlayStation before its Steam release, these games launched simultaneously across platforms:

Wo Long: Fallen Dynasty and Lies of P, like WUCHANG, were also available day one on Game Pass, making them valuable case studies.

Notably, Wo Long shows the highest PlayStation-to-Steam ratio among benchmark peers, in part due to Koei Tecmo’s strong PlayStation presence. Over 40% of its PS player base comes from China.

We estimate its total audience at 1.6M+ on PlayStation, 500K+ on Steam and 5M+ on Xbox, driven by its Game Pass launch.

Lies of P reflects a more balanced platform split, with around 1M players each on Steam and PlayStation and an estimated 6M players on Xbox, driven by its Game Pass launch.

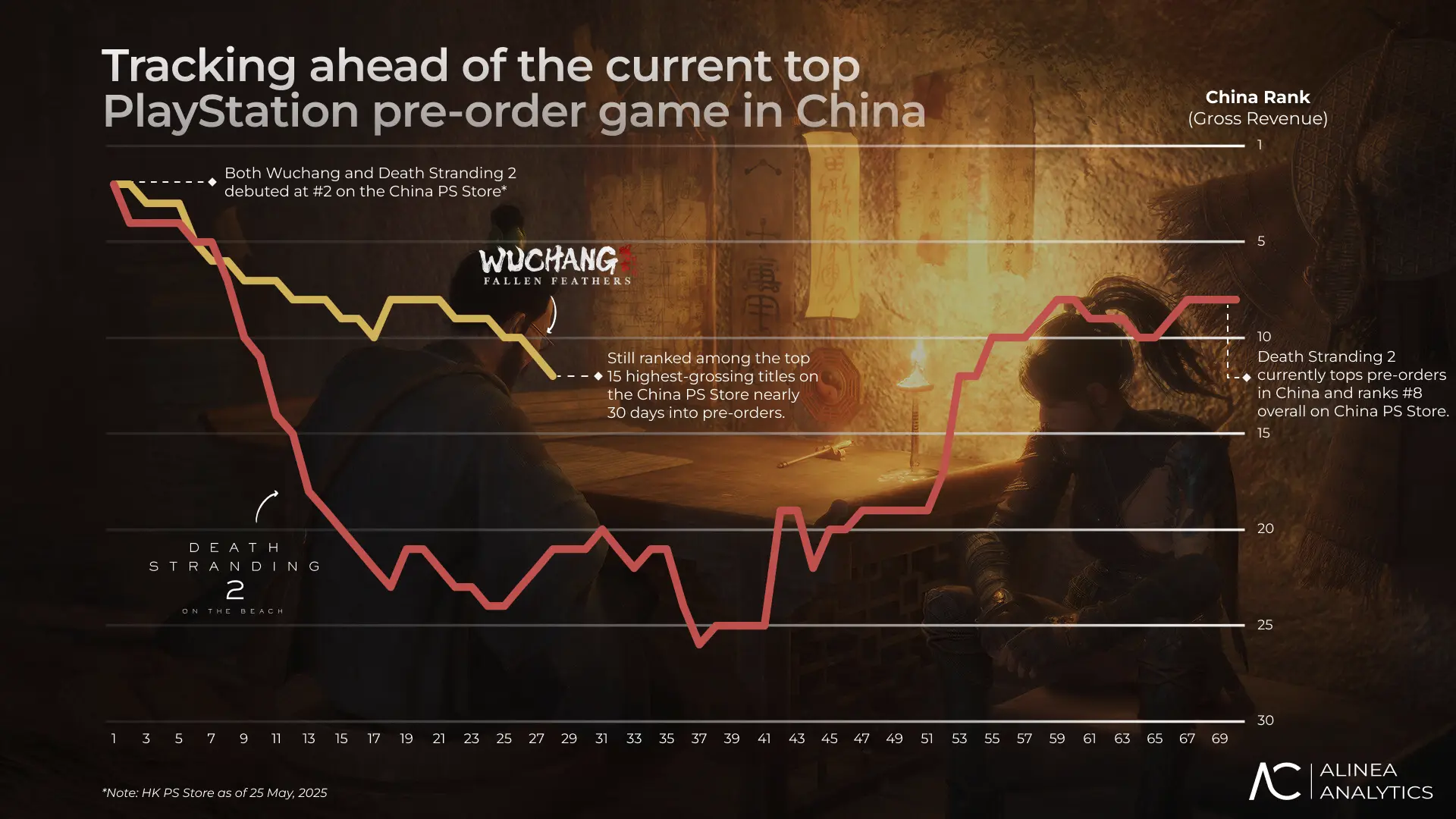

WUCHANG’s PlayStation pre-orders tell a compelling story:

It debuted as the #2 top-selling title on the China PlayStation Store, trailing only behind Clair Obscur: Expedition 33 at launch, which had fully launched earlier that same week.

In the US, pre-orders opened at #60, outperforming key peers at launch such as:

- Wo Long: Fallen Dynasty (#90 in the US)

- Lies of P (#97 in the US)

- Metaphor: ReFantazio (#102 in the US)

Despite WUCHANG’s day one availability on Game Pass, pre-order momentum on PlayStation remains strong. In China, WUCHANG currently trails only Death Stranding 2: On the Beach, a remarkable achievement, considering that the original Death Stranding sold over 4 million copies on PlayStation, with the US and China as its core markets. When comparing pre-order debuts, WUCHANG is actually outperforming Death Stranding 2 at this point in China.

Given the title’s strong appeal among particularly Chinese PlayStation users, a 40% console-to-Steam attach rate for WUCHANG seems like a reasonable target. To hit a 40% attach rate, WUCHANG would need to sell around 500K copies on PlayStation in its first month, not an unrealistic goal given current pre-order momentum and market signals.

For context:

- The lowest-performing benchmark, Berserk, sold 282K units in its first month.

- Remnant II holds the lowest Steam-to-PlayStation attach rate at ~30%, with 367K units sold in its first month.

- The median benchmark title sold approximately 382K units in its first month.

- Lies of P (also a day one Game Pass title) moved 365K units in its first month, while Wo Long: Dynasty reached an impressive 1.2M units in the same timeframe.

Assuming a blended ASP of $36 after discounts and regional pricing, this translates to approximately $20 million in gross revenue in the first month.

As a day one Xbox Game Pass title, WUCHANG can also expect a guaranteed upfront payment from Microsoft, let’s assume $5M, at the low end of the rumored range of $5–10 million for AA peers.

With a projected $30M dev budget (see final section), this would cover 15–20% of development costs upfront. After missing out on Black Myth: Wukong, Microsoft secured WUCHANG ahead of last year’s Xbox Partner Preview.

Strategically, this makes sense for the studio, as Steam and PlayStation dominate China, much of Asia, and indeed the world. Game Pass availability is unlikely to significantly cannibalize regional sales, as evidenced by pre-orders and benchmark titles.

The title will also generate additional Xbox sales from non-Game Pass users, let’s assume 5% of PlayStation sales, which would translate to roughly 25K extra copies and $1M in revenue.

Finally, let’s ballpark the game’s budget:

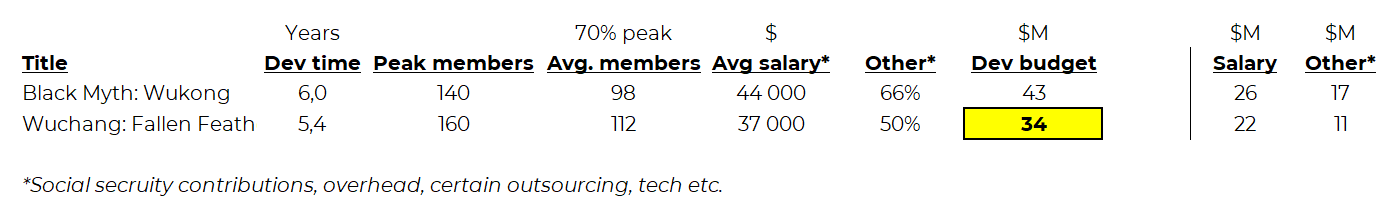

As of May 2025, the WUCHANG: Fallen Feathers team has grown to about 160 people. Development started around March 2020, with a gameplay reveal at Bilibili’s Video Game Festival in September 2021. The game is set to release on July 24, 2025, making the development cycle roughly 5.4 years.

For comparison, Black Myth: Wukong took about six years to develop with a reported development budget of $43 million. Developers in Shenzhen, where Game Science is based, earn about ¥320,000 ($44,000) per year on average, much less than the $103,000 US average. In Chengdu, where Lenzee is located, salaries start even lower, around ¥267,000 ($37,000) per year.

Black Myth’s team grew from 7 to 140 members throughout development, while WUCHANG has expanded from 5 to 160 members. Applying a 70% peak-to-average team size rule and assuming lower overhead for WUCHANG, a rough dev budget estimate is around $30 million.

Assuming a 50/50 revenue split between Digital Bros and Lenzee, each party’s dev capex would be approximately $17 million.

Additionally, it is speculated that Black Myth: Wukong had approximately $27 million allocated to marketing, about 40% of its total $70 million budget. Marketing for WUCHANG: Fallen Feathers has already started, notably, the game lit up the Chengdu Towers in February 2025. Let’s estimate a total budget of around $50 million for WUCHANG.

A final word on the upcoming competition:

With many direct competitors yet to announce release dates, WUCHANG’s 2025 launch window is likely working in its favor.

These are the titles to watch closely in terms of wishlist-to-wishlist affinity:

- Over 30% of WUCHANG’s wishlisters have also wishlisted Stellar Blade, which is poised to take over media coverage on and after June 11.

- Over 15% have also wishlisted Tides of Annihilation, which has yet to confirm its release date.

- Other notable affinity titles to keep an eye on include: Hell is Us (Sept 4), Ghost of Yotei (PS5 exclusive Oct 2), Lost Soul Aside (Oct 29), Crimson Desert (TBD) and NINJA GAIDEN 4 (TBD)

If Leenzee and 505 Games deliver on both gameplay and setting, WUCHANG: Fallen Feathers has the potential to emerge as one of 2025’s sleeper hits.

The game will be featured at Summer Game Fest on Friday, June 6, offering players another glimpse before its anticipated debut in July.

Want more insights like this delivered straight into your inbox? Subscribe to the Alinea Insight newsletter.